The portfolio of a mutual fund scheme generates returns from the appreciation in the value of the securities held and the income received on these securities, such as interest and dividend. These returns belong to the investor and reflect in the appreciation in the NAV of the scheme. The returns are received or realized by the investors either in the form of dividends paid by the mutual fund to the investors or as capital gains when the units are redeemed by the investor. These returns are taxable in the hands of the investor when they are received depending upon the nature of the investment, the period of holding the investment and the type of investor. Mutual fund schemes are considered equity-oriented schemes if not less than 65% of the net assets are invested in equity and equity-linked instruments.

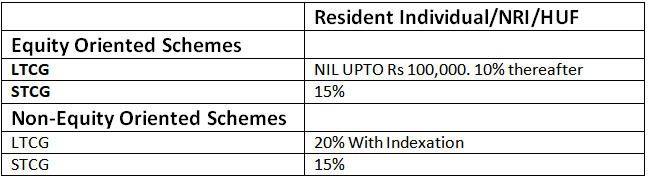

Tax on Capital Gains – Capital gains tax applies to the gains realized on redemption or sale of units. The rate of tax depends on the nature of capital gains: short-term or long-term. The holding period of the investment before redemption in order to categorize the gains as short or long term capital gains depends upon the type of fund. In case of equity-oriented funds, if the units were held for not more than 12 months before they were redeemed or sold, the gains are considered short-term-term capital gains (STCG), else it is long-term capital gains (LTCG). For non-equity oriented schemes, the gains are categorized as short-term capital gains if the units were held for not more than 36 months before redemption. Else it is long-term capital gains. The tax on capital gains is as follows:

Indexation is the process of calculating long-term capital gains for tax purposes after adjusting the purchase price for inflation. The adjustment is done using the cost of inflation index issued by the Central Board for Direct taxes for each financial year. Indexation ensures that the increase in the value of the investment that can be attributed to inflation is not taxed, and only the real return is taxed.

NRI investors in mutual funds alone have tax deducted at source at the rate of 15% for STCG in equity-oriented funds and at the rate of 30% and 20% for STCG and LTCG from nonequity-oriented funds. Surcharge and education cess will be added to these rates as applicable.

Investors can set-off a capital loss incurred on the sale or redemption of their investments against taxable gains made on other investments. This will reduce the tax that has to be paid. This is called set-off and if a capital loss cannot be set-off against a capital gain of that particular year, it can be carried forward for the next eight years. The applicable rules are:

Short-term capital loss can be set-off against long-term and short-term capital gains.

Loss arising from a long-term capital asset can be set off only against long-term capital gains.

Short-term or long-term capital loss can be set off only against income under the head capital gains and not any other source of income.

A loss under any other head of income can be set off against short or long term capital gain.